Costing methods are an essential aspect of any business operation. It is the process of determining the expenses involved in producing a product or providing a service. Costing methods help businesses determine the manufacturer price, ensuring that they can make a profit while remaining competitive in their industry. Choosing the right costing method can drive potential customers straight to your business, while making the wrong choice can cause you to experience heart palpitations and even result in negative outcomes for your balance sheet.

Selecting the appropriate costing method entails evaluating various factors such as production processes, company goals, and target market. Businesses need to consider all possibilities when selecting a costing method to avoid making costly mistakes that could lead to that stress-related trip no one wants. In this article, we will explore different costing methods and their importance in helping businesses make informed decisions that support growth and profitability. Understanding which costing method is most suitable for your business could be the difference between success and failure.

Additional reading: Job Order Costing

Discover the Meaning of Costing Method and Why It Matters

Costing methods are a vital component of any business, as they help determine how much it costs to produce goods or services. The term costing method refers to the way a company calculates its costs, which can differ based on various factors such as the type of product, production process or accounting method. Ultimately, the aim of any costing method is to assign costs accurately and fairly so that pricing decisions can be made with confidence.

Specific costing methods let businesses analyze their expenses in detail. For instance, job-order costing tracks individual jobs or orders separately while process costing combines all costs related to a particular production run. Having these specific costing methods lets businesses identify where their money is going and pinpoint areas where they could potentially cut back on expenses. This helps them make better-informed decisions about pricing strategies and product development.

Inventory valuation methods are closely tied to costing methods because they deal with how businesses value the remaining inventory at the end of an accounting period. Inventory valuation is critical because it affects several financial statements, including income statements and balance sheets. Different costing methods will use different inventory valuation methods, which is why choosing the right one is crucial for accurate financial reporting. Overall, understanding and selecting the correct costing method is essential for businesses looking to manage their general manufacturing costs effectively and remain profitable over time.

Broaden your view: Inventory Turnover Ratio

Unleashing the Power of a CA - The Ultimate Guide

How can you unleash the power of a Chartered Accountant (CA)? The answer lies in understanding the costing methods that a CA can employ to help your business. CAs are professionals who have completed rigorous training and education through the Indian Institute of Chartered Accountants. They are well-versed in both Indian accounting standards as well as international accounting standards. By utilizing their knowledge of costing methods, they can help businesses make informed decisions regarding pricing, budgeting, and profitability.

Discover the Exclusive Concept of Last Come, First Serve

The LIFO method is the exact opposite of the FIFO method assigning the cost of recent inventory costs to items sold last. This concept assumes that newer products are more expensive due to inflation, and therefore, a company should prioritize selling its newest goods first to avoid holding onto them for too long. The LIFO concept adheres to the principle that the last goods in are usually the first ones out (LCFS), which can be helpful when trying to reduce taxes on profits as it considers inflationary trends.

Why Cost Accounting Can Benefit Your Business

Cost accounting is a highly customizable practice that can benefit any specific firm. Unlike financial accounting standards board (FASB)-driven financial accounting, cost accounting is adapted, tinkered and analyzed with insider eyes for internal purposes management. By using cost-accounting methods, adaptable managers can analyze information based on specifically valued resources and distributed capital to determine the most efficient allocation of said resources. This allows businesses to make informed decisions that optimize profits and reduce costs in the long term.

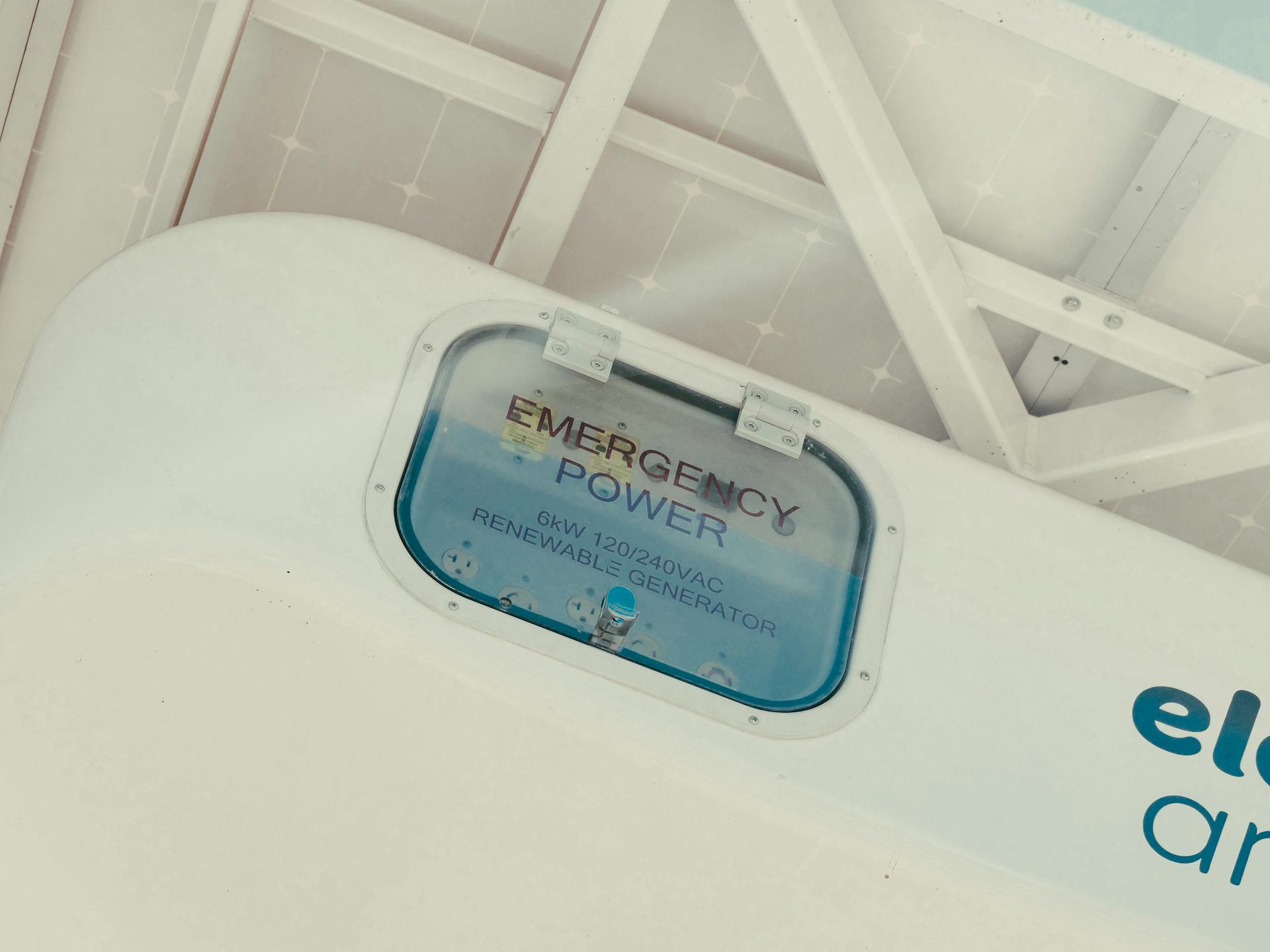

Suggestion: Ac Generator Cost

The Top Costing Methods You Need to Know About

When it comes to costing methods, there are several options available for businesses. Firstly, there's job costing, which is used when companies produce individual units or small batches of products. Next up is process costing, best for companies that create large quantities of homogeneous goods. Standard costing is commonly used in manufacturing industries and involves setting predetermined standards for production costs. Direct costing is another method, where direct costs like raw materials are considered while indirect costs are excluded.

Target costing is a method that focuses on pricing products based on what customers are willing to pay. Activity-based costing (ABC) is the most accurate method but takes ten times longer than other methods since it allocates indirect costs based on activities performed during the production process. These indirect costs include things like mortgage payments, electricity and water bills, equipment maintenance, and administrative expenses. Advertising costs can also be considered indirect expenses.

Calculating indirect expenses can help you get a clearer picture of your overall production costs. Production costs people tend to overlook include hidden or indirect expenses like those mentioned above- mortgage payments, electricity and water bills, equipment maintenance, administrative expenses - all of which can come together to make up a significant portion of your business running costs. Cost accountants will have the expertise required to help you calculate these figures accurately so that you can price your products correctly and keep your profit margins healthy.

Discover more: Cost of Heavy Equipment Operator Training

Master Your Stock with Wholesale Inventory Management

Manually managing wholesale inventory can be an overwhelming and daunting task. With the ever-growing demand for products, keeping up with inventory control woes is not an easy feat. However, with the right wholesale inventory management process in place, you can easily keep track of your stock.

One of the best business tips when it comes to inventory management is to use costing methods to determine the value of your stock. This helps you identify which products are selling well and which ones are not. By doing so, you can make informed decisions on what items to order more of and which ones to eliminate from your product line.

Wholesale inventory management doesn't have to be a headache. By implementing proper inventory control measures and using costing methods, you can master your stock and take your business to new heights. So why wait? Start optimizing your inventory management today!

If this caught your attention, see: Risk Management 5 Tips

Service or operating costing:

Service costing refers to the process of determining the cost of providing a specific service or product, while operating costing is used to calculate the costs associated with running and maintaining a business or organization. For instance, public bus railways might use service costing to determine how much it costs them to provide transportation services, while nursing homes may use operating costing to determine their overall expenses. Both methods help businesses make informed decisions about pricing and budgeting, and can be useful for improving efficiency and profitability.

Discover How You Can Benefit from the Average Cost Method

The average cost method assigns inventory costs based on the average cost of all units in stock, including those purchased at different prices. This means that when you sell an item, its cost is calculated by dividing the total value of your inventory by the number of units you have in stock. The moving average is then calculated and used to determine the cost of goods sold. By using this method, you can more accurately track your inventory purchase costs and make informed decisions about pricing and profitability.

Get Ahead with 'First Come, First Served' Strategy

When it comes to costing methods, the FIFO method is a popular choice for many businesses. This method assumes that the oldest costs are associated with the inventory items sold first, which means that the cost of goods sold reflects the oldest cost of inventory items purchased. By using this strategy, businesses can ensure that they are selling their oldest cost first, which can help them get ahead and stay competitive in their industry. So don't wait any longer, start implementing the FIFO method today and watch your profits soar!

Discovering the Key Elements of Cost Accounting!

Cost accounting is an important aspect of any business. Understanding cost categories such as direct costs, indirect costs, variable costs, and fixed costs is crucial to accurately determine operating costs. Direct costs are those that can be easily traced to a specific product or service, while indirect costs are those that cannot be directly linked to a product or service. Variable costs change with the production levels, whereas fixed costs remain constant regardless of production levels. By analyzing all these cost categories effectively, businesses can determine their operating expenses and make informed decisions about pricing and budgeting.

Streamline Your Business Costing Process with an ERP System

Streamlining your business costing process can be a real game-changer. By implementing a manufacturing ERP system, you can accurately track production costs and get an accurate overview of inventory costs. This will save you time and resources while increasing the accuracy of your calculations.

One of the most popular costing methods is the Moving Average Cost (MAC) system. With an ERP system, you can easily implement this method for your inventory costs. The MAC system calculates costs by averaging out the cost of all items in stock, making it easy to keep track of expenses as they change over time.

In addition to streamlining your costing process, an ERP system can also help you with production operations. With tools for figuring out how much each job will cost, you'll be able to reallocate resources more efficiently and save money in the process. Best of all, many ERP systems offer a 14-day trial so you can try before you buy!

What are different types of costing?

Different types of costing refer to the different methodologies used to calculate the costs involved in producing a product or delivering a service. There are several costing methodologies, including job costing, process costing, activity-based costing, and marginal costing. Each of these methods has its own advantages and disadvantages depending on the nature of the business and the type of product or service being offered. Understanding these different types of costing can help businesses make informed decisions about their pricing strategies and cost management practices.

Frequently Asked Questions

What is the difference between standard costing and historical costing?

Standard costing is based on expected costs and used for forecasting, while historical costing uses actual costs and is used for record-keeping.

Is financial accounting the same as cost accounting?

No, financial accounting and cost accounting are not the same. Financial accounting focuses on the preparation of financial statements, while cost accounting deals with determining and analyzing the costs incurred in producing goods or services.

What are the objectives of cost accounting?

The objective of cost accounting is to help a business determine the actual cost associated with each product, service or project. It also helps in identifying areas where costs can be reduced and assists management in making informed decisions.

What are cost accounting formulas?

Cost accounting formulas are mathematical equations used to calculate the various costs associated with running a business. They help managers determine the expenses involved in producing and selling a product or service, and make informed decisions based on that information.

What are the different types of cost accounting?

The different types of cost accounting include job costing, process costing, activity-based costing, and standard costing. These methods help businesses determine the costs associated with producing their products or services and make informed decisions about pricing and profitability.

Featured Images: pexels.com